Obtaining an Employer Identification Number or Tax ID Number for an Estate

Once a Personal Representative has been appointed to administer an estate, the estate will require an EIN / TIN (employment

identification number / tax identification number). Below are the steps to obtain the EIN / TIN and avoid the sites that require payment.

Before getting started you will need to gather the following information:

- Deceased’s social security number (found on the death certificate)

- Deceased’s date of death (found on the death certificate)

- Personal Representative’s social security

- Address for the Estate (usually the Personal Representative’s or the attorney’s)

- County of the Probate proceedings and date Probate was opened

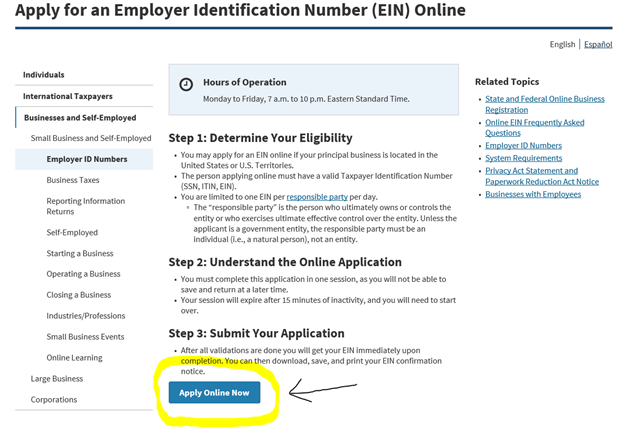

Step 1: Go to the IRS website to apply for an EIN using this web address:

https://www.irs.gov/businesses/small-businesses-self-employed/apply-for-an-employer-identification-number-ein-online

Step 2: Click on Apply Online now.

Step 3: On the next screen, click on Begin application

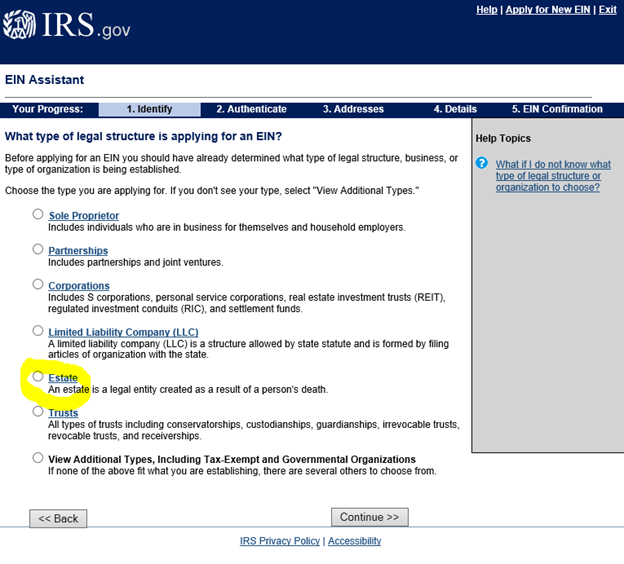

Step 4: There will be a list of options to select the reason you’re applying for an EIN. Choose the circle next to Estate and click continue.

Step 5: Click continue again to confirm that you’re applying

for an Estate EIN.

Step 6: The next screen will require information on the

Deceased. Click enter once information is entered.

Step 7: The next 2

screens will require information on the Personal Representative. Enter the

information required for each screen and click continue to proceed through the

application process.

Step 8: After entering the information regarding the

Personal Representative, you will have to enter the address for the Estate.

This address will be where the mail for the Estate is being sent. This is

usually the Personal Representative’s address or the Attorney’s.

Step 9: The next screen requires information on the estate,

including the county and state where probate was opened, the month and year it

was opened and the accounting year end date. Click continue once this

information has been entered.

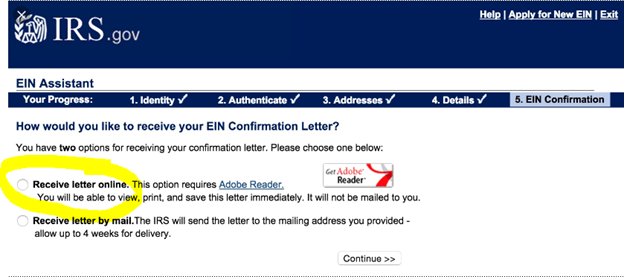

Step 10: At the end of the application, you will be asked if you want to receive the EIN letter online or mailed to you. Select online and click continue.

Step 11: At the bottom of the next screen there will be a

link to open the letter to print and save the EIN immediately.